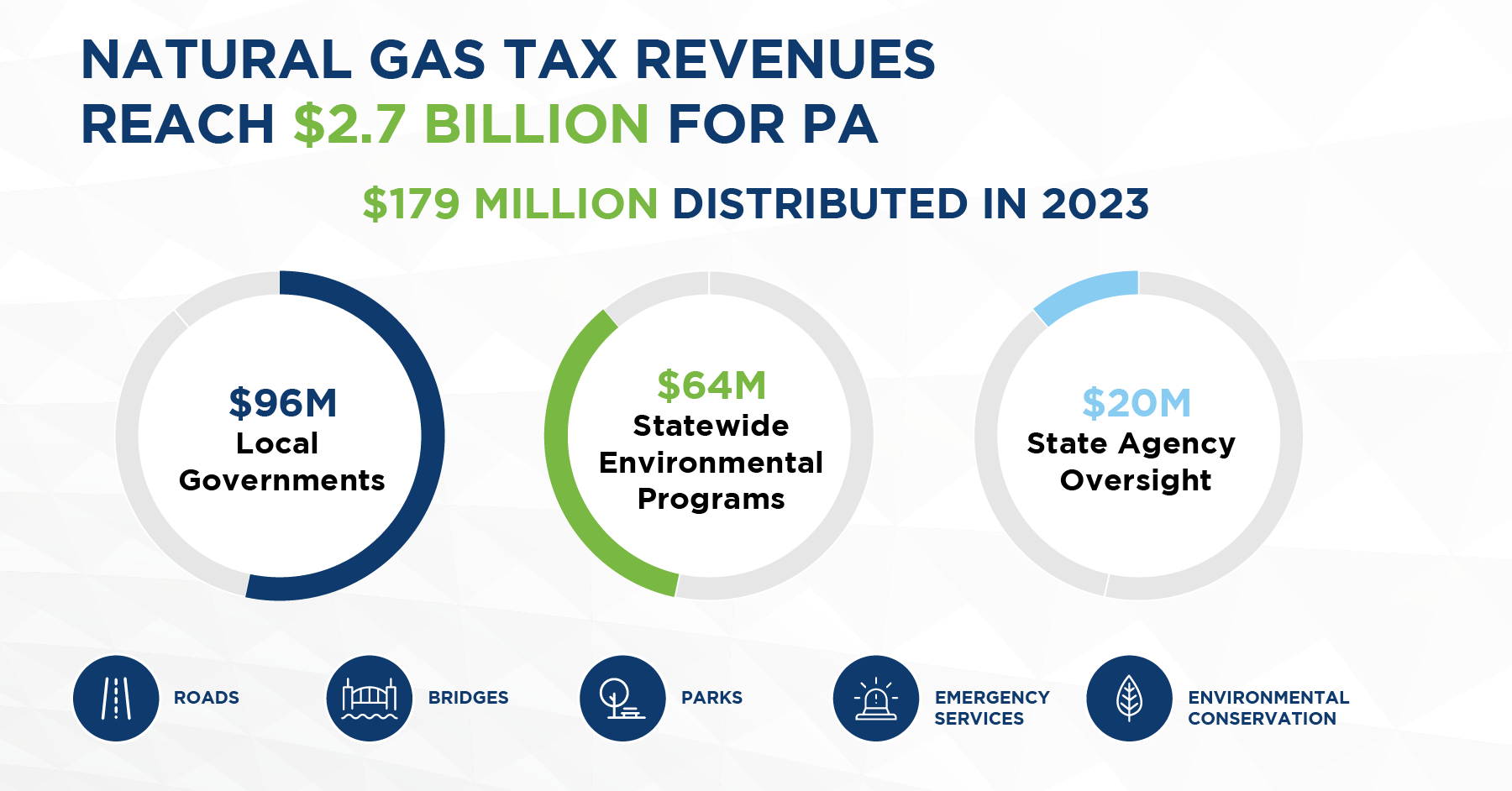

Pennsylvania’s innovative natural gas tax and distribution structure has generated billions for local communities, with the $179.6 million 2023 distribution bringing the 13-year total to over $2.7 billion, the PA Public Utility Commission (PUC) announced this week.

“By every measure, natural gas benefits all Pennsylvanians, state agencies and services provided by counties, townships and boroughs across the Commonwealth,” Marcellus Shale Coalition president Dave Callahan said in a release.

Established in Act 13 of 2012, annual impact fee payments from unconventional operators are tied to drilling activity in the state as well as the national benchmark commodity price for natural gas. The impact tax is just one component of the overall ~$6 billion in local, state and federal taxes paid by the industry, according to MSC’s economic impact analysis.

Of the $2.7 billion paid by producers since 2012, $1.8 billion has supported community-specific initiatives ranging from storm water & sewer upgrades to workforce training, emergency preparedness and social services, among others. More than $700 million from the total has been invested in statewide initiatives and services, including:

- $246 million – Water & Sewer Infrastructure

- $197 million – Marcellus Legacy Grants

- $99 million – Growing Greener Fund

- $95 million – County Conservation Districts

- $78 million – Pennsylvania Department of Environmental Protection

Through empowering local governments to invest in vital community projects, this distinctive model ensures natural gas development contributes to both local and statewide quality of life, fostering balanced and sustainable growth across the Commonwealth – even in the places where little to no activity occurs.

“By ensuring that townships and other areas impacted by natural gas drilling receive their fair share of funding, the impact fee supports essential projects like road and bridge repairs, public safety, affordable housing, and infrastructure improvements,” said Pennsylvania State Association of Township Supervisors executive director David Sanko.

These funds are designed to support projects and services that fit the unique needs of each community.

In Butler County, for example, officials allocate a majority of impact fee returns to their infrastructure bank, which can be tapped to fund road, bridge, water and other critical improvements as they’re needed.

“We’ve been able to reinvest in about $60 million worth of projects throughout the county since 2017 in over 20 municipalities,” County Commissioner Kim Geyer told the Butler Eagle.

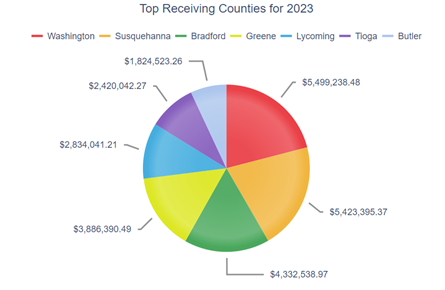

Other local governments have chosen to use the funds for residential tax reductions. Washington County, which received the largest sum this year, hasn’t raised taxes in 13 years because they supplement their county budget with impact fees.

“Our communities will have significant support that doesn’t burden taxpayers for public infrastructure needs, like stormwater systems, emergency preparedness, environmental programs, tax reductions and social services,” commented State Senator Camera Bartolotta, who represents Washington and Greene counties.

Top natural gas producing counties Washington, Susquehanna, Bradford, Greene, and Lycoming will receive the largest combined distributions to county and municipal governments—totaling over $60 million in 2023 alone.

“The natural gas industry has been a great partner in creating new jobs and opportunities, and today’s announcement is another reminder of the importance of this industry in Pennsylvania,” said State Senator Gene Yaw, representing Lycoming, Bradford, Tioga, Union and Sullivan counties.

Statewide funds supported by the impact fee include programs like the PA Housing Affordability & Rehabilitation Enhancement (PHARE) fund, and the Marcellus Legacy Fund’s Greenways, Trails, and Recreation Program, and Watershed Restoration Protection Program, among others, maintaining Pennsylvania’s beauty no matter the zip code.

“Even though York County does not have any active natural gas drilling, it still benefits from Pennsylvania’s natural gas industry,” Senator Kristin Phillips-Hill said.

“The fees levied make it a better place for all of us by improving area parks and streams.”

While revenue is down compared to last year, an MSC analysis found Pennsylvania natural gas consumers realized nearly $1.85 Billion in utility savings due to the drop in natural gas prices between 2022-2023. What’s more, additional data shows improved air quality from the use of natural gas across the power generation sector delivered between $450 billion to $1.04 trillion in cumulative public health benefits to Pennsylvania residents.

As MSC’s Callahan concludes, “this economic progress is occurring alongside significant environmental gains as well, with the increased use of natural gas driving substantial air quality improvements.”