Revenue generated from Pennsylvania’s natural gas tax is expected to reach a near-record $233 million this year, state projections show, making available more resources for statewide environmental programs, conservation efforts and community-level infrastructure investments.

According to Pennsylvania’s non-partisan Independent Fiscal Office (IFO), the state’s tax on natural gas development is projected to generate $88 million more compared to last year – or about $98 million more when adjusting for inflation.

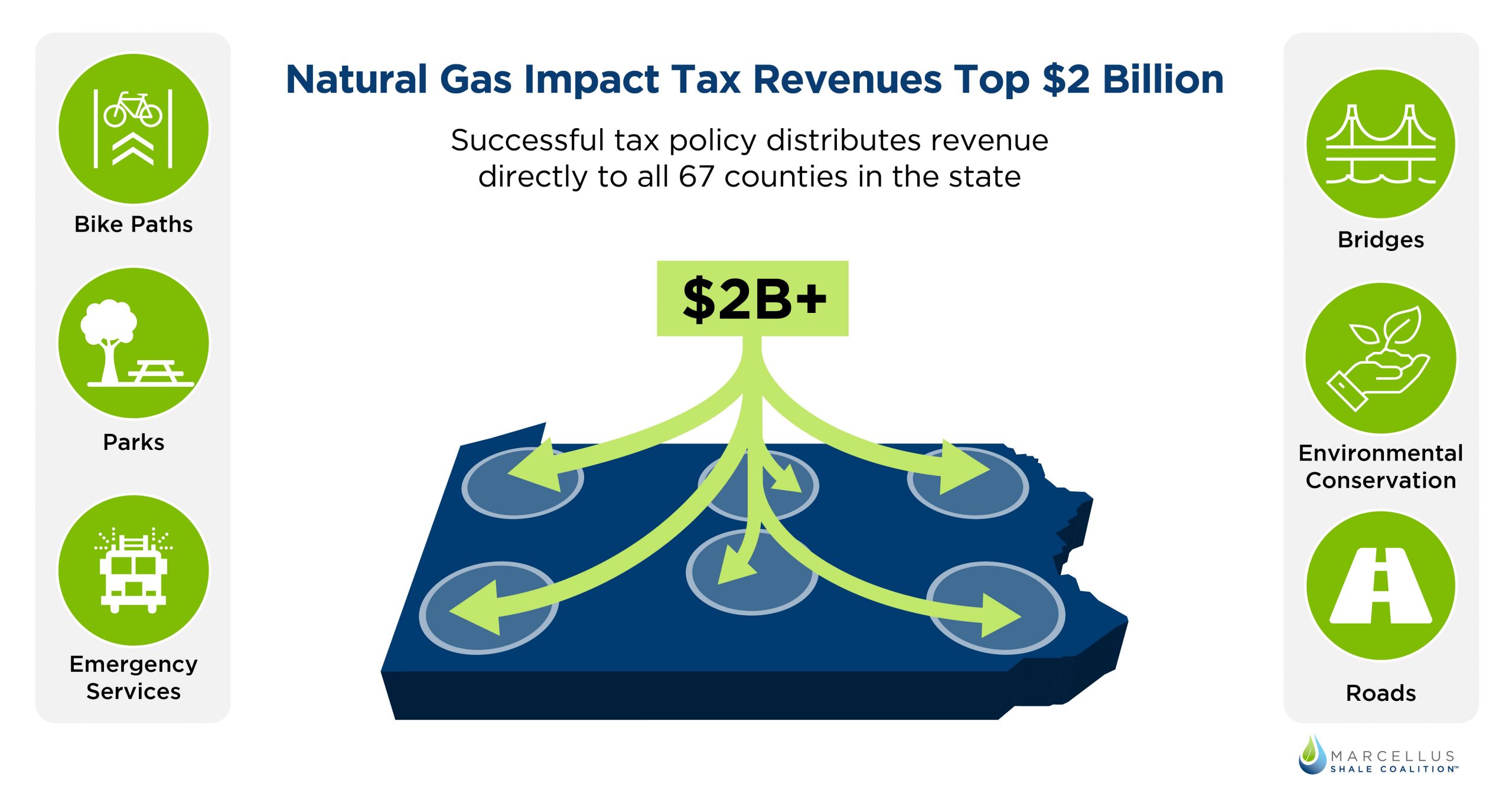

“Pennsylvania’s impact fee is a successful tax policy that, in addition to the billions of dollars in investments and all other business taxes paid by the industry, demonstrates how natural gas development is an added benefit to each of Pennsylvania’s 67 counties,” MSC’s Callahan wrote in a letter to the Scranton Times-Tribune.

Proceeds from this tax have exceeded $2 billion since the program’s inception in 2011, with the majority of revenues flowing directly to counties and municipalities across the Commonwealth. Empowering local leaders to decide how funding is best distributed, support can be in the form of park rehabilitation projects, infrastructure upgrades, environmental conservation, or filling other budgetary gaps.

Take, for example, Bradford County’s state-of-the-art Public Safety Center that was built using impact fee dollars. Or in Washington County, where taxes haven’t been raised in more than a decade because impact fee revenue provides critical budget flexibility.

“We have a low debt service in the county and we haven’t raised taxes in 12 years, so we’re very grateful to have this revenue stream and very grateful to see that it’s starting to return,” said Washington County Board of Commissioners Chairwoman Diana Irey Vaughan.

Even counties without natural gas production share in the impact fee revenues. Philadelphia County – which has no natural gas development – has received approximately $25 million in impact fee funding since 2011.

These are just a few of the many significant opportunities made possible for communities and residents thanks to Pennsylvania natural gas.

Still, some continue to advocate for additional and higher energy taxes. This would be a step in the wrong direction for Pennsylvania, casting a chilling effect on future investments and job creation in the Commonwealth.

To put it in the words of leaders from Pennsylvania House Democrats’ Southwestern Delegation, “targeting a single industry with another layer of taxes – our oil and gas industry that employs tens of thousands of Pennsylvanians – is a nonstarter…This is not just a tax on the oil and gas industry, it would be a tax on our pandemic recovery.”

They’re absolutely right. And for the township supervisors and county commissioners across the state, the more than $2 billion in revenue collected from the impact fee continues to be a critical revenue source.

“Levied on top of all other business taxes paid in the commonwealth, this tax structure empowers local leaders with the ability to target revenues to best meet their community needs, while creating a predictable, workable climate that’s key to attracting job-creating investment and growth,” Callahan recently told reporters.

Here’s more on what they’re saying:

Williamsport Sun-Gazette

Natural gas impact fees eyed for increases

Pennsylvania Business Report

Impact fees from state’s shale gas wells expected to put near-record revenues back into communities

Pittsburgh Business Times

Gas impact fee collections set to come roaring back

Towanda Daily Review

State expects $90 million in additional Impact Fee funds

Natural Gas Intelligence

Pennsylvania Natural Gas Impact Fees Projected to Rebound on Stronger Prices, Production

StateImpact Pennsylvania

Analysts forecast rise in oil and gas impact fees after prices rose in 2021

Pittsburgh Post-Gazette

Marcellus Shale impact fees projected to rebound after pandemic slump