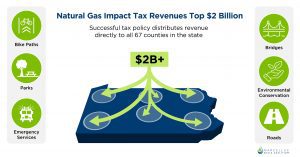

Successful tax policy delivers revenues directly to communities across all 67 counties

Pennsylvania’s natural gas impact tax has generated more than $2 billion in new revenue since 2012, including $146.3 million for 2020, the Pennsylvania Public Utility Commission announced yesterday. Proceeds from the tax, called the impact fee, largely flow directly to communities in all 67 counties and support critical infrastructure, first responders, and environmental programs, to name a few.

“The impact tax is a successful policy for Pennsylvanians, local governments, environmental conservation programs, emergency response efforts and much more,” Marcellus Shale Coalition president David Callahan said in a release.

Washington County will again receive the largest amount of disbursements, with the county and its municipalities receiving a combined $12.2 Million, per PUC data. Other top recipients include Susquehanna ($11.2M), Bradford ($9.3M), Greene ($8.8M), Lycoming ($6.3M), Tioga ($4.9M), and Butler ($3.8M) counties.

While a majority of funding goes to the regions with natural gas production, what’s unique about Pennsylvania’s tax framework is that even counties without activity share in the tax revenues.

This revenue is an important source of funding for municipal and county governments, who have the flexibility to use the dollars in ways that fit the needs of each respective municipality or region.

Additionally, roughly 40% of Act 13 monies are directed to the Marcellus Legacy Fund to support statewide programs including bridge and infrastructure repairs, water and sewer projects, Commonwealth Financing Authority grants, the Environmental Stewardship Fund, hazardous site cleanup, and more.

In less than a decade, the impact tax has provided:

- $60 Million to the Department of Environmental Protection for environmental oversight of the natural gas industry;

- Over $69 Million in new revenue to county conservation districts;

- Over $73 Million for Pennsylvania’s Growing Greener program;

- Over $146 Million for the Marcellus Legacy Fund, which invests in watershed protection, parks, trails, recreation, open space conservation, farmland preservation and other environmental enhancement programs; and

- Nearly $183 Million in water and sewer infrastructure projects.

Here’s what local elected officials, small business owners, township supervisors, and community leaders are saying about the impact fee’s significance and projects supported by the tax:

Williamsport Sun-Gazette: Impact fee to boost economy, despite $55 million dip in distribution

From a regional perspective, the impact fee distribution will deliver more than $27.8 million to area county and local governments this year, said state Sen. Gene Yaw, R-Loyalsock Township, who is chairman of the Senate Environmental Resources and Energy Committee.

“The natural gas industry has been a great partner in creating new jobs and opportunities in our communities, and this week’s announcement is another reminder of the importance of this industry in Pennsylvania,” Yaw said.

Bucks County Government: County Opens New Creek Road Bridge In Warwick Township

After a six-month closure in which an 83-year-old span was replaced, Bucks County this week reopened Bridge No. 138 in Warwick Township, which carries Creek Road over a tributary to the Little Neshaminy Creek…The $1.1 million project, part of Bucks’ ongoing County Bridge Program, was paid for through state Act 13 Marcellus Shale Legacy Funds.

Observer-Reporter: $33 million in impact fee money coming to SW Pennsylvania communities this year

Impact fee money also goes to the Department of Environmental Protection to help pay for oversight of the industry, and to county conservation districts and the Marcellus Legacy Fund, which invests in environmental enhancement projects like parks, trails and farmland preservation.

Lock Haven Express: Clinton County to get $572,979 in natural gas impact tax

This year, communities in Northcentral Pennsylvania will receive a combined $24.4 million in revenue to support important county and municipal programs. Clinton County will receive $572,979; Centre County, $257,510, and Lycoming County, $6,311,567.

Williamsport Sun-Gazette: Area agencies to receive money for housing assistance

Kendra Parke, marketing coordinator, American Rescue Workers, said the agency is grateful to receive $100,000 for its rental assistance program…A rent moratorium prevented tenants from being penalized or evicted by landlords during the pandemic, but now many of those people are faced with paying back rents. “And we are helping them do that,” Parke said. “We are grateful to receive that money.”

WENY: More than $680,000 awarded to Bradford Co. housing efforts

“This is another example of how our region continues to reap the benefits of its abundant energy resources,” State Representative Tina Pickett said.

York County Dispatch: Jackson Township celebrates opening of Little Creek Community Park

“I think it’s great for Jackson Township and the surrounding communities,” York County President Commissioner Julie Wheeler said. “[It’s] a great use of Marcellus Shale funds to enhance parks, to create a recreation playground for children and adults.”

State Senator Camera Bartolotta: Impact Fee Brings Millions Back to 46th Senatorial District

“Ten years of the Impact Fee tax has provided millions of dollars to the communities in which we live. Strong local support, as well as safe and predictable regulations, are the key to our continued success.”

“Today’s announcement should serve as yet another a reminder to policymakers that the natural gas industry’s role in creating broad-based economic, environmental and national security benefits is essential and that our current tax framework is the right choice for the Commonwealth,” said Callahan.

For a breakdown of each Pa. county and its municipalities’ combined share of Act 13 distributions, visit the Pennsylvania Public Utility Commission’s website.