Governor Wolf’s latest natural gas tax hike jeopardizes Pennsylvania jobs, threatens national security, stings families with higher energy costs, and further stalls our economic recovery, lawmakers from both parties and business leaders said.

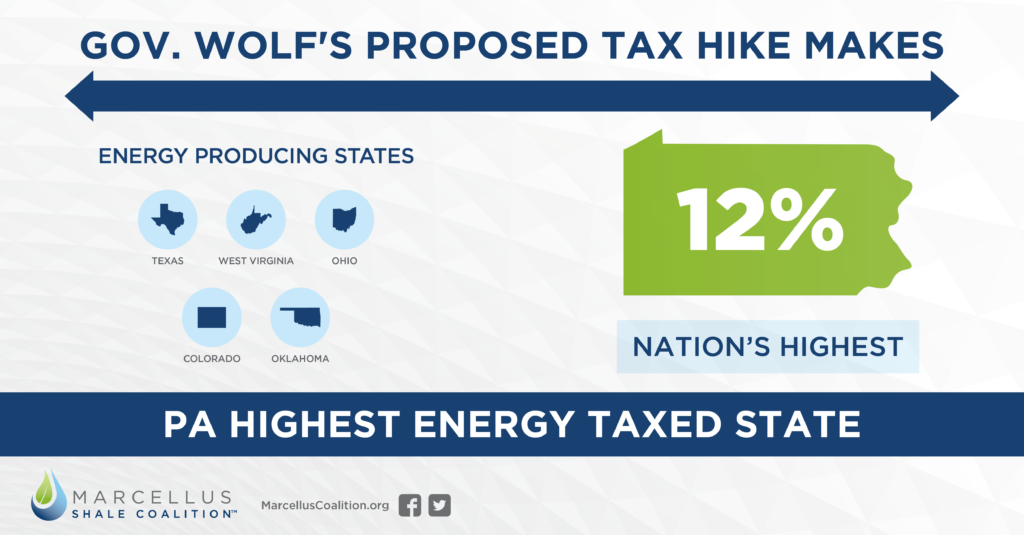

During his seventh annual budget address, the Governor again proposed a massive energy tax increase that, combined with the existing impact fee, or tax, would make Pennsylvania the highest energy taxed state in the country.

Pancaking taxes on top of taxes will have a chilling effect on the capital investments needed to create jobs and grow our economy.

Natural gas is essential to Pa.’s economy – as was made clear during the 2020 election – and many are proud that our state is a leading producer of the clean energy helping to overcome the pandemic, put Americans back to work (especially for union men and women), and accelerating the growth of renewable energy resources.

Pennsylvania natural gas operators already pay their “fair share” in taxes to the state through the Impact Fee established nearly ten years ago. That tax program, which has generated nearly $2 billion to date, was designed specifically to benefit each county, regardless of drilling activity, and support community and environmental programs, infrastructure upgrades and repairs among other nonprofit initiatives.

The Governor said his plan will help make Pennsylvania a better place to live and work, but “if the goal is to tax the very product that is helping combat this pandemic, put more Pennsylvanians out of work, burden consumers with higher energy costs, add more layers of taxpayer debt, and to deepen our foreign energy reliance, then Governor Wolf’s plan is the right one,” the MSC said in a release.

Here’s What They’re Saying:

Pa. House Democrats’ Southwestern Delegation: “This is not just a tax on the oil and gas industry, it would be a tax on our pandemic recovery.”

“Targeting a single industry with another layer of taxes – our oil and gas industry that employs tens of thousands of Pennsylvanians – is a nonstarter. This industry was deemed an essential industry by Governor Wolf last year, has produced the materials to manufacture the PPE that allowed us to respond to the pandemic, and is now producing the byproducts that are fueling the manufacturing, storage, and distribution of the vaccine to Pennsylvanians. This is not just a tax on the oil and gas industry, it would be a tax on our pandemic recovery.”

Pa. Chamber of Business and Industry: “Higher energy taxes puts one of the Commonwealth’s greatest competitive advantages at risk.”

“The pandemic has highlighted the critical role the state’s energy supply and infrastructure has on our economy, as an emphasis on teleworking continues. Pennsylvania’s prolific natural gas reserves have helped to keep energy costs low throughout the state, and oil and gas are vital feedstocks to manufacturing sanitizer, PPE, medical equipment, and shipping the vaccine – and, most notably, one of the ingredients in the coronavirus vaccines used to deliver the molecule into the body is derived from petrochemicals. Higher energy taxes puts one of the Commonwealth’s greatest competitive advantages at risk.”

Dave Taylor, Pa. Manufacturers’ Association: “The best way for state government to get more revenue out of the natural gas industry is to help it grow.”

“Governor Wolf’s proposal for a new, additional tax on Pennsylvania energy production threatens our commonwealth’s business competitiveness and America’s role as a global energy leader. The best way for state government to get more revenue out of the natural gas industry is to help it grow. The industrial dynamism that will be fueled by gas development will be bigger than the drilling activity itself.”

“Manufacturers rely on natural gas and natural gas liquids as a fuel source and as feed stock. All modern manufacturing that comprises all the products we use every day – plastic, rubber, Styrofoam, paints, glazes, coatings, solvents, and adhesives – have their foundational footprint in natural gas or a related natural gas liquid. Natural gas is also the primary feed stock for medical equipment and supplies being used to combat the COVID-19 pandemic as it’s used to produce hypodermic needles, respirators, and personal protective equipment needed by our frontline workers.”

Pa. Senate Appropriations Vice Chair Elder Vogel (R-Beaver): “Further taxing gas extraction would not produce the revenue he projects and would more likely devastate the industry and cost jobs.”

Pa. State Rep. Martin Causer (R-Turtlepoint): “The natural gas industry is more important now than ever.”

“We do not need another energy tax. To be honest, the natural gas industry is more important now than ever because they are actually producing the materials to manufacture the PPE supplies that have allowed us to respond to the pandemic. And the byproducts that are fueling the manufacturing, the storage and distribution of the vaccine.”

Pa. State Sen. Camera Bartolotta (R-Washington): “This approach has not worked the first six times Governor Wolf tried it, and it is an even worse idea now when so many Pennsylvanians are out of work and families are struggling to pay bills.”

“Governor Wolf continues to push for a job-crushing tax on natural gas that will hike utility bills statewide and chase away new investments in our community. This approach has not worked the first six times Governor Wolf tried it, and it is an even worse idea now when so many Pennsylvanians are out of work and families are struggling to pay bills.”