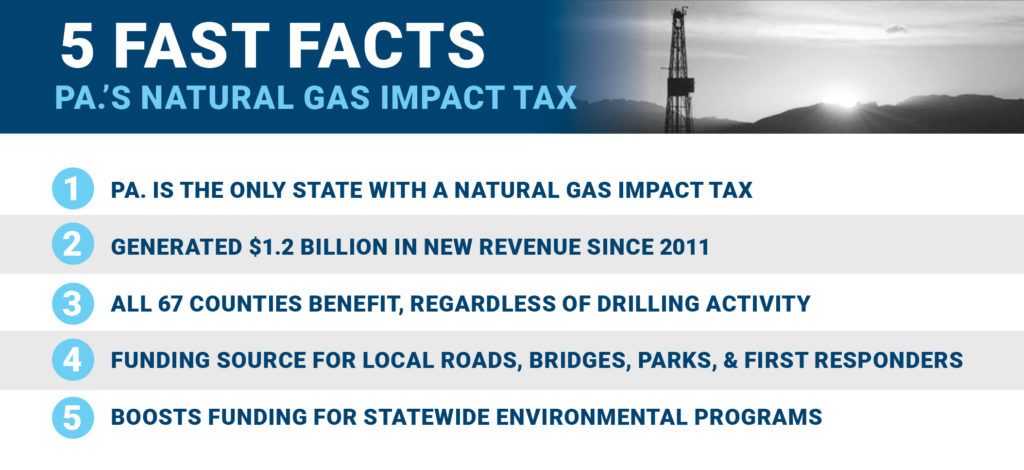

Revenue generated by Pa.’s natural gas impact tax has topped $1.2 billion since 2011, the state’s Public Utility Commission announced recently. The upcoming distribution of more than $173 from Pa.’s unique tax on natural gas, is, as one Beaver Co. commissioner put it, “happy news for the commissioners and happy news for the county.”

In a statement, MSC’s Dave Spigelmyer explained how the tax is benefiting communities all across the state with sustained revenues.

“Pa.’s unique tax on natural gas – called the impact fee – continues to be a policy solution that’s working as designed, directly benefitting communities in all 67 counties throughout the Commonwealth. Since 2011, Pa.’s impact fee – which currently equates to a 9.16% effective natural gas tax – has generated more than $1.2 billion in revenue supporting community programs, local infrastructure projects, as well as statewide environmental and conservation initiatives. This unique natural gas impact tax empowers county and municipal leaders by keeping revenues local for community projects.”

Over the past six years impact tax revenues have enabled communities to improve roads and bridges, build new parks, and upgrade first responder services.

Cogan House Township Supervisor Howard Fry, for example, said the impact tax has been used to update equipment and do repairs, putting the Lycoming Co. community “in good shape right now.” Other local officials pointed to road paving, new police cars and construction equipment, and improvements to courthouses and municipal buildings – all completed without having “to raise taxes [or] borrow any money,” according to one local official – as some examples of the benefits from this tax.

Yet some Harrisburg politicians insist on putting forth plans to increase energy taxes and jeopardize these direct local benefits. Gov. Wolf’s proposed massive energy tax increase – which would make Pa. the nation’s highest-taxed natural gas producing state – is concerning to many locally elected officials like Jessup Township supervisor Dennis Bunnell. From WBRE-WYOU:

Bunnell just hopes state lawmakers don’t eliminate the impact fee program in order to impose a severance tax. “For (Gov.) Wolf to change that structure, I would be sad. I would be sad because I think this is where the money should be,” Bunnell said.

Here’s what community leaders are saying about Pa.’s natural gas impact tax benefits.

- Impact Tax Revenues “Happy News for the County”: Beaver Co. is set to receive $335,961 this year in impact fees, which is expected to be delivered in early July. That number is an increase over the $319,259 the county received last year. In addition to the money given to the county, the 54 municipalities combined in Beaver Co. will receive $381,709, an increase over the $326,000 the municipalities received last year. … Beaver Co. Commissioner Tony Amadio said Thursday that although the county’s overall general-fund budget is $74.5 million, the $335,961 in impact fees is “happy news for the commissioners and happy news for the county.” … According to the data released Thursday, [New Sewickley] township will receive $104,106 this year. Township Manager Walt Beighey said Thursday that number is more than he expected. … [Marion] Township secretary and treasurer Marilyn Zona on Thursday said the increase is welcome news and added that township officials previously used impact fee moneys to pave a road and to buy a new police car. (Beaver Co. Times, 6/16/17)

- Natural Gas Impact Tax Revenues Have “Repaired Bridges and Saved Farmland in Lancaster Co.”: Extracting natural gas from the Marcellus Shale regions of Pa. has funded local farmland preservation, replacement and improvement of several aging rural bridges and, in part, a new roof for Lancaster Central Market. … To date, the county has received nearly $6.2 million in natural gas impact tax money since the program began statewide in 2012. … To date, the impact fee has raised $1.2 billion statewide over the past six years. In Lancaster Co., of the $6.2 million in impact fees allocated to the county so far, about half, or $3.1 million, has been spent. Most of that has been used on three bridge projects: A new deck for a concrete bridge over Little Chiques Creek between East Donegal and Rapho townships on Drager Road. Replacement of the bridge on White Oak Road over the Conestoga River in Earl Township. A new deck and painting of the iron bridge over the Conestoga River on Iron Bridge Road in East Earl Township. The county will consider using some of its remaining infrastructure impact fee funds to rehabilitate the covered bridge over the Pequea Creek on Penn Grant Road in Strasburg and West Lampeter Townships …. The county also has committed $50,000 toward the campaign to replace the Central Market roof, which is expected to cost $1.5 million. (Lancaster Online, 6/20/17)

- Local Officials Turn to Natural Gas Impact Tax Revenues, Not Tax Hikes, for Local Projects: If you’ve driven by the Susquehanna Co. courthouse in the last year, there’s no doubt you have noticed all of the construction. A huge renovation project like that would normally increase taxes but because commissioners used impact fee money from natural gas drilling there was not a direct tax hike. From the year 2016, state officials just announced Susquehanna Co. will get $4.8 million in impact fee revenue. … In Jessup Township, supervisors used to have to borrow money to make payroll by the end of the year. For the last six years, impact fee money has changed everything. “We’ve purchased a new grater, a new loader, new equipment, we’ve roofed our buildings, painted our buildings,” supervisor Dennis Bunnell said. … In Susquehanna Co., the next big project commissioners want to use money for is the creation of a new 911 facility along with the help of state and federal grants. “We’ll also back-fill and use the impact fee money to help build that so that we never have to raise taxes and we don’t have to borrow any money,” Commissioner Hall said. (WBRE-WYOU, 6/16/17)

- Pa.’s Natural Gas Impact Tax “A Policy Solution Working As Designed”: Most of the money, about $93 million, goes to county and municipal governments, while smaller amounts are earmarked for environmental improvement programs, roadway repairs and water and sewer infrastructure upgrades. Washington Co. was the largest recipient of 2016 impact fee revenue, at $5.38 million. Greene Co. also was among the top recipients, netting $3.7 million. Three Greene Co. municipalities also were among the top gainers among local governments. Morris Township will receive $770,940; Center Township, $730,772; and Cumberland Township, $646,602. The $173 million in distributions announced by PUC on Thursday brings the total generated from Pa.’s natural gas impact tax to $1.2 billion in revenues since 2011. … “Pa.’s unique tax on natural gas – called the impact fee – continues to be a policy solution that’s working as designed, directly benefitting communities in all 67 counties throughout the commonwealth, [MSC president David Spigelmyer said.] Since 2011, Pa.’s impact fee – which currently equates to a 9.16 percent effective natural gas tax – has generated more than $1.2 billion in revenue supporting community programs, local infrastructure projects, as well as statewide environmental and conservation initiatives. This unique natural gas impact tax empowers county and municipal leaders by keeping revenues local for community projects. We understand the budget challenges that Pa. faces, but proposals to enact even higher energy taxes – along with even more costly and unnecessary regulations – hurt the commonwealth’s competitiveness and our state’s ability to attract job-creating investment.” (Observer-Reporter, 6/16/17)

- Local Officials: Higher Energy Taxes Threaten Impact Tax Benefits: [Susquehanna Co. Commissioner Alan Hall] expressed his concern about a potential severance tax. “They could pass one piece of legislation and take it all away,” he said. … According to Hall, Susquehanna Co. taxpayers have saved over $30 million since the impact fees first began rolling in in 2012. He also noted the county’s $9 million courthouse renovation and the new $8 million 911 Center that will come at no cost to residents because of impact fees. “We don’t have to borrow money, create debt or raise taxes to fund these projects,” he said. “We need to hang onto the impact fees.” Cabot Oil & Gas recently announced it has now paid out over $1.5 billion in royalties to Susquehanna Co. landowners since its drilling operations began there. “People can’t even fathom what $1.5 billion is,” he said. “What that will do for landowners and their families for generations to come is just incredible.” … Wyoming Co. Commissioner Tom Henry said he and his fellow commissioners were content with the result. … Henry said Wyoming Co. has been frugal with its impact fee monies through the years, keeping some in reserve accounts and providing tax breaks to its residents. In the last four years, the commissioners have also used the funding to convert heating at county-owned buildings to upgraded systems capable of utilizing natural gas. … Sullivan Co. Commissioner Donna Iannone said her county has used its impact fee funding primarily for tax relief, public safety, infrastructure improvements and judicial services. She said a new 911 tower was erected to improve emergency communications while a new heating and air conditioning unit was installed in the courthouse. The courthouse also received upgraded computer systems under the category of records management and information technology. (Rocket-Courier, 6/15/17)

- Impact Tax “Disbursements Allow Township to Put Additional Money into Roads”: “We just put it in the capital fund reserve,” said [Derry Township] Supervisor David Slifka. “There is $568,312 in Act 13 funding in there now, and we did use it to buy a truck last year.” Slifka said the disbursements allowed the township to put additional money into road repairs. [Sewickley Township Supervisor Brian Merdian said] “we’re blessed to be able to have these proceeds, and we don’t want to overextend.” Merdian said township officials may pull from their disbursement if they need to supplement forthcoming federal grant funding for improvements at Crabapple Park and Pool. Unity Township Supervisor Chairman John Mylant said the money typically is pooled with other funds for roadwork projects. “We’re grateful to get anything,” he said. (Tribune-Review, 6/15/17)

Join the conversation on social media using #SayNoToSeverance on Twitter, liking the MSC on Facebook, and visiting our blog.