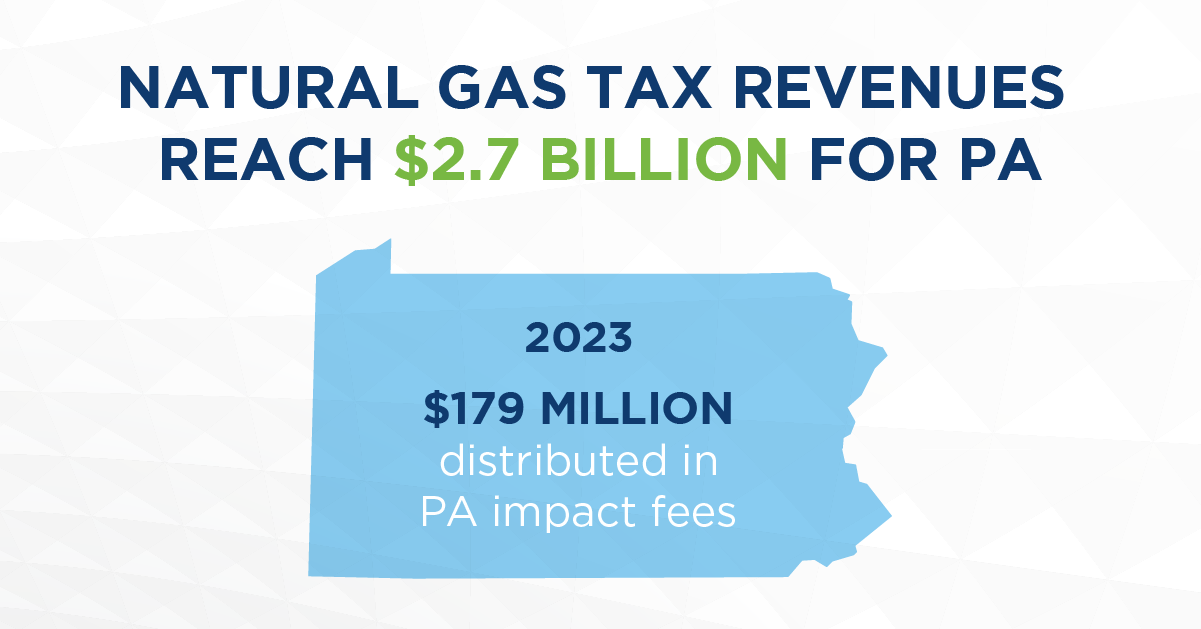

Natural Gas Impact Tax Returns Near $180 Million in 2023

$2.7+ billion generated by the impact tax since 2012 one component of total industry tax contributions supporting essential government services

PITTSBURGH, PA – June 18, 2024 – Pennsylvania’s tax on natural gas production generated $179.6 million this year, the Pennsylvania Public Utility Commission (PUC) announced today, bringing the 13-year total to more than $2.7 billion in revenues that fund essential community services. Established in 2012, the natural gas impact fee is a tax on natural gas development, with proceeds that reach across Pennsylvania, including those without active drilling operations.

Overall, in 2022, natural gas development in Pennsylvania generated more than $5.8 billion in local, state and federal tax revenues, according to a Marcellus Shale Coalition-commissioned economic analysis. The industry also supports more than 120,000 Pennsylvania jobs and contributes $41 billion in statewide economic activity. These careers typically pay an average wage of just under $100,000, which is more than double the median wage in Pennsylvania.

In addition to economic and family-sustaining career opportunities, Pennsylvania’s emergence as the nation’s second largest natural gas producer delivers direct home energy savings for every consumer. Pennsylvanians realized more than $1.8 billion in energy savings last year compared to 2022, according to MSC analysis of state data, due to lower natural gas prices in the Commonwealth. Consumers also realized hundreds of millions of dollars in additional savings thanks to lower electricity prices directly tied to the increased use of natural gas in the power generation sector.

“By every measure, natural gas benefits all Pennsylvanians, state agencies and services provided by counties, townships and boroughs across the Commonwealth,” said Marcellus Shale Coalition president David Callahan. “This economic progress is occurring alongside significant environmental gains as well, with the increased use of natural gas driving substantial air quality improvements.”

“This industry and the tens of thousands of Pennsylvanian workers it supports are proud to do our part in driving our economy and communities forward with more than $6 billion generated in tax revenues and tens of billions of more investment into our economy,” Callahan continued.

While all counties receive a percentage of the annual impact tax revenues, distribution is weighted towards the counties, townships and boroughs that host development. Impact fee totals fluctuate annually, as the tax is based on factors including number of wells drilled, age of each well and commodity price environment.

“Pennsylvania’s first-in-the-nation Natural Gas Impact Fee represents a forward-thinking policy that requires companies to send funding to affected communities instead of purely to state capitals,” said Pennsylvania State Association of Township Supervisors executive director David Sanko. “By ensuring that townships and other areas impacted by natural gas drilling receive their fair share of funding, the Impact Fee supports essential projects like road and bridge repairs, public safety, affordable housing, and infrastructure improvements.”

The Pennsylvania Public Utility Commission announced the 2023 total today, with the commission disbursing funds later this month. Since Act 13 was enacted in 2012, more than $2.7 billion has been generated through the impact fee program.