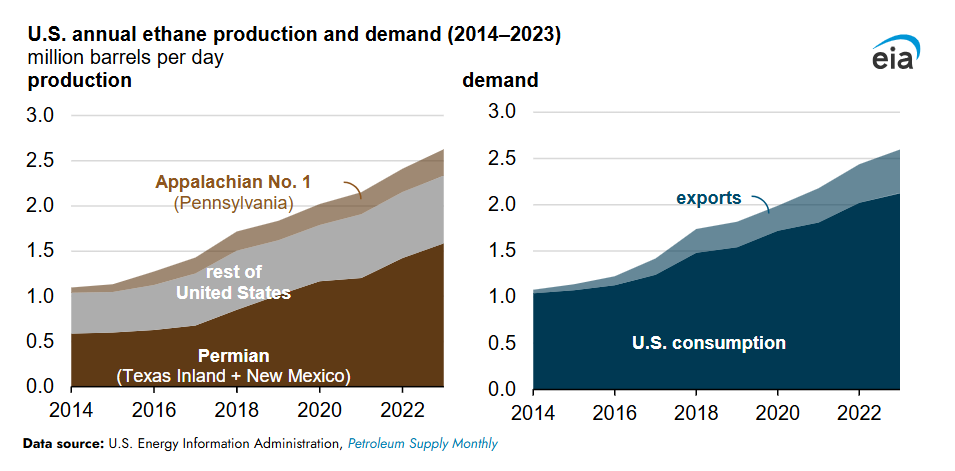

Significant growth in domestic natural gas production and the buildout of natural gas liquid (NGL) infrastructure drove a 135% increase in U.S. exports of ethane and ethane-based petrochemicals between 2014 and 2023, the U.S. Energy Information Administration (EIA) reported.

Ethane, a natural gas liquid (NGL) found in the wet gas areas of the Marcellus and Utica Shales, is the chemical precursor to ethylene, a substance that’s used to make a wide range of everyday products including plastics, fertilizers, clothing, as well as life-saving medical equipment, devices and pharmaceuticals. These essential products would not be possible without America’s robust natural gas and oil production.

Eleven percent of America’s ethane comes from the Appalachian Basin, according to the EIA – yet another way our abundant energy resources provide tremendous additive value , boosting the U.S. economy and our security while advancing strategic global trade.

Looking back, Marcellus Shale pioneer Range Resources was “the first operator to sign a deal for waterborne exports of ethane in the United States,” CEO Dennis Degner recalled during a fireside chat with Marcellus Shale Coalition president Dave Callahan.

The 2012 deal with European chemical manufacturer Ineos supplied ethane sourced from Houston, Pennsylvania in Washington County overseas via the Marcus Hook terminal near Philadelphia, opening up “the global natural gas liquids market for Appalachian producers” and helping “serve as a building block for the potential expansion of the region’s petrochemical industry,” said Jeff Ventura, Range’s then-CEO.

As important as our ability to support U.S. trade and diplomatic interests are the natural gas industry’s contributions to the “Made in America” manufacturing revival. In addition to containing the hydrocarbon resources necessary to make products, access to abundant, low-cost natural gas attracts developers and powers our economic engine. This has re-shored numerous manufacturers, particularly in the chemical, plastics and fertilizer sectors, all of which rely heavily on NGL feedstocks and thrive with affordable, clean, reliable power. As an example, in 2022, the American Chemistry Council estimated that more than $200 billion in chemical industry investments were tied to the Shale Revolution.

Importantly, these projects not only lead to thousands of high-paying jobs but also revitalize local economies and communities.

In fact, chemical and plastic manufacturing alone accounted for over 85,000 Pennsylvania jobs in 2023, a 6% increase compared to 2022. As natural gas remains an affordable energy source, American manufacturers will continue to operate with lower costs, positioning them to outpace their international competitors.

To fully realize the potential of our natural gas and NGL resources we need more NGL infrastructure, including pipelines, export terminals, and processing plants. Debottlenecking the system will allow production to meet rising domestic and international demand for the basic chemical building blocks that are essential to our everyday lives.