Collections from Pennsylvania’s version of a severance tax, the impact fee, topped $234 million for 2021, the Pennsylvania Public Utility Commission reported. This is a 60 percent increase from the previous year and second highest on record.

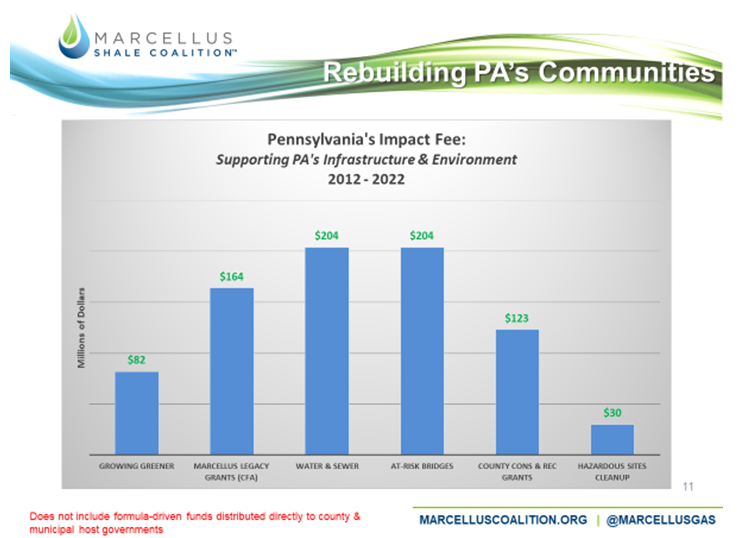

Since 2012, the natural gas tax has generated more than $2.3 billion in revenue that directly benefits municipal and county governments, as well as statewide environmental conservation programs and state agency oversight of the industry.

“Our industry provides much more than clean and abundant natural gas,” Marcellus Shale Coalition president David Callahan said in a release. “Good-paying jobs, economic prosperity, and – as demonstrated by the impact fee – sustained community investment programs are all made possible through responsible Pennsylvania natural gas development.”

The Marcellus Legacy Fund will receive more than $86M, which is distributed to every county in the Commonwealth, regardless of development activity. This windfall revenue will help fund conservation, transportation and safety programs, among other things, in local communities across Pennsylvania.

A majority of revenues ($129 million) will flow to county and municipal governments for infrastructure upgrades, emergency response, community redevelopment, conservation programs and property tax relief.

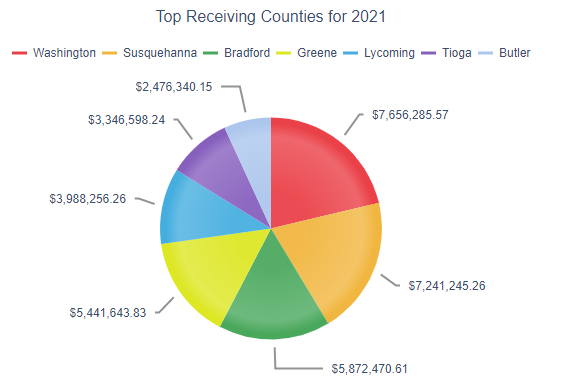

Top receiving counties this year include:

- Washington County: $7.6M

- Susquehanna County: $7.2M

- Bradford County: $5.8M

- Greene County: $5.5M

- Lycoming County: $3.9M

- Tioga County: $3.3M

- Butler County: $2.4M

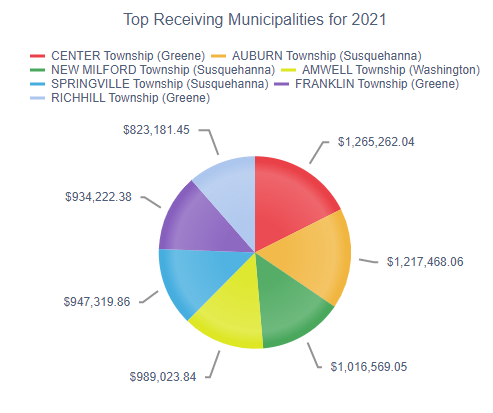

Within the counties where drilling takes place, municipalities also receive direct revenue:

- Center Township (Greene County): $1.2M

- Auburn Township (Susquehanna County): $1.2M

- New Milford Township (Susquehanna County): $1M

- Amwell Township (Washington County): $989K

- Springville Township (Susquehanna County): $947K

- Franklin Township (Greene County): $934K

- Richhill Township (Greene County): $823K

“Generating $2.3 billion in essential funding for state and local governments across all 67 counties, Pennsylvania’s unique natural gas tax is an effective policy that yields impactful results,” Callahan said.

Revenue from the impact fee also supports statewide environmental initiatives through the Marcellus Legacy Fund as well as key regulatory oversight programs.

In addition to the millions of dollars in disbursements to local governments and communities, County Conservation Districts and the State Conservation Commission are to get $8.8M+ and the PA Department of Environmental Protection will receive $6M. Additionally, the Fish & Boat Commission, PennDOT, and Pa. PUC will each receive $1M, with the office of the State Fire Commissioner receiving $750K.

Headlines from Pa. Communities:

Western Pa. counties, municipalities to see bump in money from fees on natural gas production

State’s natural gas impact fee rises sharply with production increases

Indiana County is getting more Act 13 money than last year

Nat Gas Fees Generate $234M as GOP Targets Dems Over Energy Policy

![]()

Natural gas impact fee generates $234M for Pennsylvania communities

McKean Co. and municipalities to receive $1.12 million from shale impact fees

Pennsylvania PUC’s gas drilling impact fee distribution rises in 2021

![]()

Local municipalities receive over $10M in impact fees