Five years ago, Pennsylvania enacted a tax on natural gas production – called the impact fee – that’s generated more than $1 billion in new revenue for communities in all 67 counties. This provision of Act 13 – a law passed with wide bipartisan majorities – continues to work as designed, directly benefiting communities as well as state environmental and conservation programs throughout the Commonwealth.

While Governor Wolf is pursuing another massive job-crushing energy tax increase, community leaders continue to remind lawmakers that the natural gas impact tax “is a good thing. It’s working. And it needs to stay.”

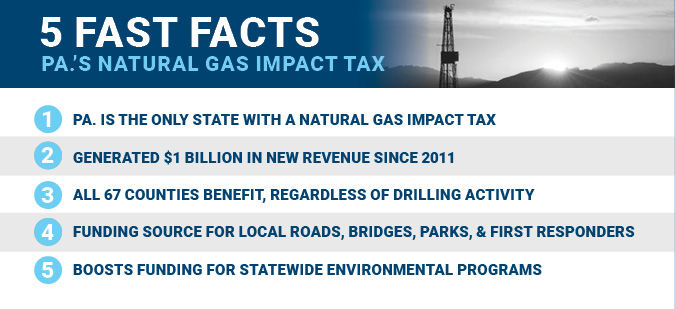

On the fifth anniversary of the impact tax’s passage, consider these five facts:

The Pennsylvania Association of Township Supervisors affirmed that these essential revenues “have helped townships upgrade infrastructure and complete public improvement projects that wouldn’t be possible otherwise.” And the County Commissioners Association of Pennsylvania supports “maintaining existing shale gas impact fees” as the system has “brought improvements in environment and infrastructure in all 67 counties.”

What’s more, a study released last year by experts at Indiana University touted Pa.’s natural gas impact tax as a winning national model. The authors concluded that other states should consider “adopting targeted reinvestment policies for energy development that are similar to Pennsylvania’s impact fee structure.”

Here’s what local officials are saying about Pa.’s natural gas impact tax that’s “been a definite help” and “huge benefit” for communities throughout the Commonwealth.

SOUTHWESTERN PA

- Amwell Township Supervisor Wayne Montgomery: The annual natural gas impact fee allocation is “a godsend.” “We’ve been able to do things at the park, on roads, with fire departments, stuff like that,” he said. “If we didn’t have the money, we wouldn’t be able to do all of this.” (Observer-Reporter, 6/6/16)

- Fallowfield Twp. Supervisor Wilbur Caldwell: “Act 13 [impact tax] funds have been extremely beneficial to townships, especially in Washington County. We’re able to do things we couldn’t dream about before Act 13. [Losing Act 13 impact tax revenues] would be a very sad demise.” (Observer-Reporter, 2/7/17)

- Greene Co. Commissioners Chairman Charles Morris: The passage of Act 13 of 2012 (Impact Fee) has greatly eased the financial burden of the County in addressing the issues that have arisen. … Needless to say, the Impact Fee has been a blessing to Greene County.” (Testimony, 3/3/15)

- Butler Co. Assoc. of Twp. Officials President Charles Stowe: “Without the Act13 impact fees many of the projects and purchases would not have happened or at least be put on hold. The impact fees have helped our townships hold the line on local taxes, plan for the future, and have expanded services for our residents. … The Act 13 impact fees have been the icing on the cake to help our communities to better serve their residents. They have been a shot in the arm to many of our smaller municipalities.” (Testimony, 3/3/15)

- Franklin Twp. Supervisor Reed Kiger: “Certainly it’s been a real asset to us,” Kiger said of drilling and the impact tax fees. “We haven’t had to raise taxes in 30-some years. It’s saved us a lot of money.” (Observer-Reporter, 2/7/17)

NORTHWESTERN / CENTRAL PA

- McKean Co. Commissioner Joe DeMott: “We’re happy to be getting that [impact fee revenue]. It comes in very handy. This money is certainly beneficial to us when we’re working with these projects that would be cost prohibitive without it. I’m really happy we’ve had the drilling we have had, and would encourage more in the future.” (Bradford Era, 6/11/15)

- Impact Tax Revenues Improve Titusville Playground: In addition to Burgess Park receiving some fresh paving, the playground will receive a new bed of mulch, due to a grant written by City Finance Director Diana Durstine. … The Act 13 grant total is for $7,957, and will be used to purchase engineered wood fiber mulch. (Titusville Herald, 2/18/16)

- Rural Ambulance Services Receive Boost from Impact Tax: Municipalities are participating in the Cameron Co. Ambulance Service board following a funding pledge to ensure continued service to residents. Act 13 funds will provide much of the revenue. (Bradford Era, 2/14/16)

NORTHEASTERN PA

- Tioga Co. Commissioners: “Act 13 made possible upgrades in areas until now that were not financially possible. … Thoughtful consideration of investment of Act 13 Impact fee is happening every day in Tioga County, focused on opportunities to overcome the challenges for the benefit of everyone. All 67 counties benefit from the Impact Fee. Act 13 is a good thing. It is working. It needs to stay!” (Testimony, 3/3/15)

- Susquehanna Co. Commissioners Chairman Alan Hall: “The passage of Act 13 Legislation has had a huge impact on Susquehanna Co. … Municipalities and the County have used funds to improve bridges, sewer systems, roads, parks, and equipment to name a few. It has also allowed the entities the ability to free up other revenue streams to improve facilities, reduce debt, and prepare our communities for the future. … Without the impact fees the County, municipalities, and townships would be in serious trouble. … The loss of the Act 13 funding would mean deteriorating conditions throughout the County with roads, bridges, infrastructure, lost jobs, and large tax increases throughout.” (Testimony, 3/3/15)

- Washington Twp. supervisor Dan Huff: The impact fee system, rather than a tax, works better for small towns, Huff said, because they’re guaranteed a check every year and not dependent on the market. “My fear is [that severance tax revenues] will get funneled away from the counties up here.” (Scranton Times-Tribune, 6/10/15)

- Lycoming Co. Dept. of Planning and Community Development: “Act 13 funds can help advance a number of projects and leverage a great deal of private and public investment. … Thanks to the funding made available by Act 13, we have been able to undertake many much-needed public-improvement initiatives. … Act 13 revenues have been just as crucial to our affordable housing initiatives.” (Testimony, 3/3/15)

- Wyoming Co. Commissioners: “The impact fee has been a definite help to our county and to our many small municipalities whose budgets just can’t handle the effects especially the wear on their roads.” (Testimony, 2/25/15)

- Sullivan Co. Commissioner Darla Bortz: “The ‘impact fee’ that our county has received has been a huge benefit. Each of the municipalities of this county receive monies that they have used to repair roads and bridges that they would not have been able to repair with just the liquid fuels monies that they receive.” (Testimony, 2/24/15)

SOUTHEASTERN PA

- Lancaster Co. Commissioner Dennis Stuckey: “The impact fee is very valuable to the county. We have invested the Legacy Portion of the funds in our nation-leading Agriculture Preserve Program directly and with challenge grants to the Lancaster Farmland Trust.” (LNP, 6/11/15)

- Natural Gas Impact Tax Funds Berks Co. Bridge Repair: The 83-foot-long bridge, which crosses Sacony Creek near Kutztown Elementary School, is one of 59 bridges owned by the county. The nearly $1 million project is being funded with state community development aid and money Berks County receives from the Marcellus shale impact fee. The bridge will get a new deck, pavement, beams and sidewalks. (Reading Eagle, 2/23/16)

As elected leaders consider proposals for job-crushing higher energy taxes, join the conversation: #SayNoToSeverance