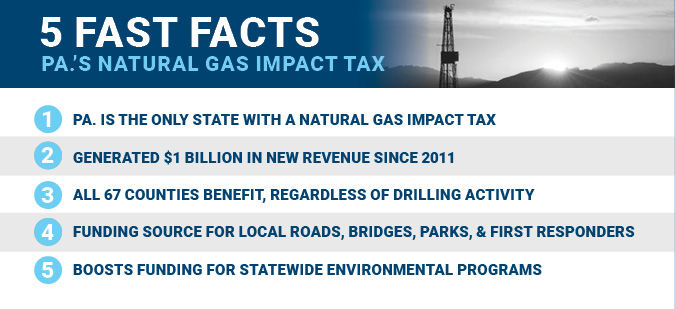

Pennsylvania’s unique impact fee – or tax on natural gas – has generated more than $1 billion since 2011, according to recently released data from the Pennsylvania Public Utility Commission [NOTE: Click here to view county + municipality totals]. In 2015, the fee-tax on responsible shale development generated more than $187 million – the overwhelming majority of which is directly distributed to local governments throughout all 67 counties.

The Pennsylvania Association of Township Supervisors said these essential revenues “have helped townships upgrade infrastructure and complete public improvement projects that wouldn’t be possible otherwise.” And MSC’s Dave Spigelmyer underscored the fact that this unique tax is working as designed, enabling local governments – not Harrisburg – to use the revenues to best benefit their communities:

“What we continue to hear from local leaders is that Pa.’s unique tax on natural gas – which has generated more than $1 billion in just five years – is an essential revenue source that’s helping to improve communities and the environment throughout the Commonwealth,” Spigelmyer said. “These critical revenues are sent directly to local governments which allows those closest to the development to invest in infrastructure improvements and community programs. It cannot be lost on anyone that Pa.’s model is working as designed and these positive community and environment benefits are absolutely jeopardized by proposals for even higher energy taxes.”

In fact, a recent Indiana University study confirmed that Pennsylvania’s natural gas impact tax is a winning model and other states should consider “adopting targeted reinvestment policies for energy development that are similar to Pa.’s impact fee structure.”

As some lawmakers in Harrisburg continue to pursue misguided proposals for even higher energy taxes, a wave of Pennsylvania voices representing local leaders, small businesses, and union leaders are united in telling Harrisburg lawmakers that such proposals threaten shale’s benefits and Pennsylvania’s impact tax is working as designed.

Here’s what they’re saying:

- Tax Revenues Generate “More than a Billion Dollars” for Pa. Communities: The fees brought in $187.7 million in 2015. … Over the past five years, the fees have brought in more than a billion dollars. Much of the money stays at the local level and is distributed to the counties and municipalities with the most shale wells. This year Washington County will receive the most money, $5.6 million, followed by Susquehanna and Bradford cos., which will get $5.2 million and $4.9 million respectively. … MSC’s Dave Spigelmyer, criticized ongoing efforts by state lawmakers to impose a production tax on shale gas. “It cannot be lost on anyone that Pa.’s model is working as designed and these positive community and environment benefits are absolutely jeopardized by proposals for even higher energy taxes,” Spigelmyer said. (StateImpact PA, 6/16/16)

- Pa.’s Impact Tax System “Much Preferable Locally Than a Severance Tax”: In total, [Beaver] Co. and its municipalities will receive $645,000. … In comparison, Allegheny Co. will receive $1.4 million this year and Lawrence Co. will get $331,000. … Despite the reduction, the PUC reported that, over the last five years, the impact fee has collected more than $1 billion. The money can be used for only a limited list of projects in counties and municipalities. That list includes construction projects, road maintenance and upgrades, bridge repair, water and sewer repairs and environmental programs, such as parks and recreation. … [Joe Weidner, the chief of staff and chief clerk for the county commissioners] added the impact fee system is much preferable locally than a severance tax being pushed by Gov. Tom Wolf. “The most important thing is that this money remains local instead of proposals to send more of this to Harrisburg,” he said. “When Beaver County really starts to be more central to gas development in the future (with the arrival of Shell Chemicals), if that money is going to Harrisburg we won’t be able to address (local) needs.” Locally, New Sewickley Township will receive the most in impact fee revenues this year with $75,430. This is the second year in a row the township has topped the list in Beaver Co. (Beaver County Times, 6/16/16)

- Cos., Municipalities Use Impact Tax Revenues for Critical Community Projects, Programs: Cos. and municipalities will split about $102 million of [the $188 million total]. … New equipment, road work and the fire department have gotten most of the money in previous years. … The $635,460 [Morgan Township] will receive this year is the seventh highest among municipalities in the state. … Officials there have used previous payments to pave roads, install a landing pad for medical helicopters and buy a maintenance truck, [Dominick Barbetta, vice chairman of Morgan Township supervisors] said. This year’s money will likely be put toward an ongoing project to extend water lines to more rural homes. … Four townships in Greene Co. are among the top recipients of impact fees this year. Among counties, Washington topped the list with $5.7 million, followed by Susquehanna ($5.3 million), Bradford ($4.9 million) and Greene ($3.9 million). … “What we continue to hear from local leaders is that Pa.’s unique tax on natural gas – which has generated more than $1 billion in just five years – is an essential revenue source that’s helping to improve communities and the environment throughout the commonwealth,” said MSC’s David Spigelmyer. (Tribune-Review, 6/15/16)

- Northeastern Pa. Communities Benefit from Natural Gas Impact Tax Revenues: State Senator Gene Yaw (R-23) today announced that his Senatorial District, consisting of Bradford, Lycoming, Sullivan, Susquehanna and Union cos., will once again receive millions of dollars from the latest round of natural gas Act 13 ‘Impact Fee’ disbursements. Senator Yaw’s Senate District will receive over $38 million in natural gas impact fee revenue this year, roughly 20 percent of the total $188 million received by the PUC. … “For the fifth year in a row, counties and local governments in my legislative district experiencing natural gas drilling are receiving needed financial support through Act 13 impact fee dollars,” Yaw said. … “I cannot remember a time when millions of dollars were sent back to our local governments without a long, involved grant process.” (Release, 6/15/16)

- Cos. without Drilling Activity Benefit from Impact Tax Revenues: Natural gas ‘Impact Fee’ disbursements have been announced and Union Co. will receive more than $35,000. Union Co. has no drilling, so it does not qualify for a share of the ‘Impact Fee’ revenue, but does qualify through the Marcellus Legacy Fund Disbursement. … Lycoming Co. which does have drilling, will receive $9.5-million. Many other counties that have drilling, including Bradford, Sullivan and Susquehanna Cos. will each receive millions of dollars in disbursements. (WKOK, 6/16/16)

- Impact Fee Tax Revenue is “A Godsend”: Amwell will receive the largest outlay among Washington County communities – $633,828. Township Supervisor Wayne Montgomery considers the annual allocation “a godsend.” “We’ve been able to do things at the park, on roads, with fire departments, stuff like that,” he said. “If we didn’t have the money, we wouldn’t be able to do all of this.” Washington County municipalities will get about $10.2 million in impact revenue, which, combined with the $5.7 million county outlay, means about $15.9 million in impact fees is headed here. Despite the dip in distributions, impact fees continue to be roundly celebrated throughout much of Pennsylvania. Larry Maggi, chairman of the Washington County commissioners, is an advocate. “We’ve done bridges the last couple of years, bridges that have been in really bad shape,” Maggi said. “Some had been closed for years, and we didn’t have to wait for (the state Department of Transportation,) didn’t have to wait for when money was available.” (Observer-Reporter, 6/6/16)

Become a United Shale Advocate today and join the thousands of other Pennsylvanians who support new jobs, not even higher energy taxes.