As some in Harrisburg continue to push for additional and even higher energy taxes which threaten Pennsylvania jobs, policymakers must consider the facts, including these:

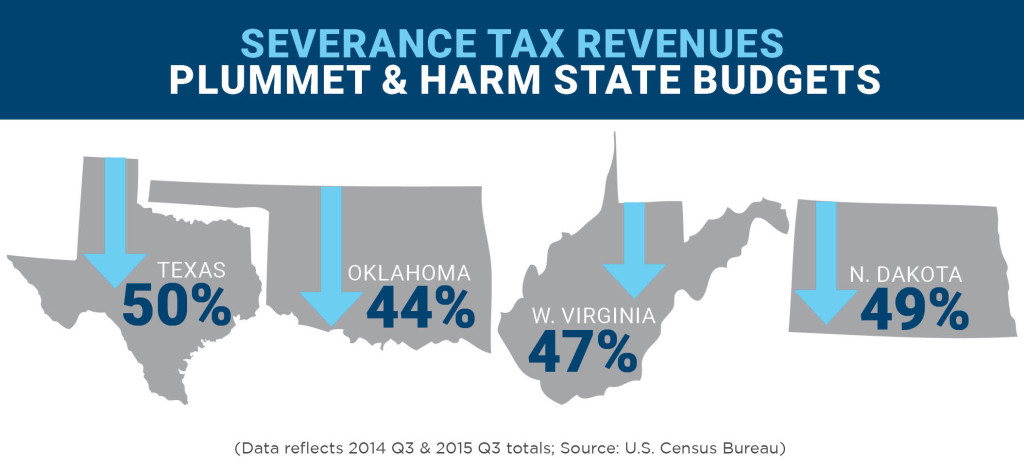

While higher energy tax advocates selectively cite taxes on the books in other energy-producing states, they perhaps purposefully fail to mention the plummeting revenues and massive budget deficits many of those states are currently facing:

Given these harsh economic realities, key energy-producing states – including West Virginia and Ohio –are taking action to freeze or lower their severance tax rates in an effort to not cause further harm to job creators across the natural gas industry supply chain.

These bipartisan efforts to stop even higher energy taxes aimed at protecting local jobs have earned praise from newspaper editorials, with the Marietta Times recently writing that “increas[ing] severance taxes on natural gas…could have severe effects…and do far more harm than good.” And the Hudson Hub Times editors agree that “hiking taxes on an industry that is experiencing a downturn doesn’t seem right.”

West Virginia lawmakers are also taking steps to lower their state’s severance tax rate in response to this prolonged energy market downturn. Spearheaded by Democratic Gov. Earl Tomblin, the state senate unanimously passed a bill this month to reduce the state’s severance tax.

So why do some in Harrisburg want additional and even higher energy taxes that will jeopardize jobs and economic opportunity?

Here’s what they’re saying:

Even Higher Energy Taxes Threaten Local Jobs

- Additional Energy Taxes Discourage Job Creation, Economic Growth: Gov. Wolf’s latest proposed natural gas severance tax would make Pa.’s shale-gas producers the highest taxed in the country. It would hurt the industry – along with the state’s economy – while it is struggling against record-low oil prices. Responsible natural gas development has provided a major boost to our local economy. … Thanks to the Marcellus Shale-driven growth of the Marcus Hook Industrial Complex, shipping traffic on the Del. River is at its highest level since 2008. Production of shale resources is creating jobs and revitalizing manufacturing. Adding a severance tax to the impact fees already charged to well sites would damage this new economic driver and push jobs to neighboring states with lower tax burdens. The governor and local elected officials should encourage job creation, investment, and growth, not discourage them with tax increases. (Phila. Inquirer letter, 2/25/16)

- Higher Energy Taxes Would “Destroy Jobs” and “Harm Consumers”: Natural gas development is the engine for economic growth in Pa. … Thanks to an abundance of cheap gas, we see a resurgence in manufacturing. … With the slump in drilling, this is no time to clamp a state severance tax on gas companies. The tax would drive up production costs, destroy jobs, diminish revenues and harm businesses and consumers. (Times-Tribune letter, 2/19/16)

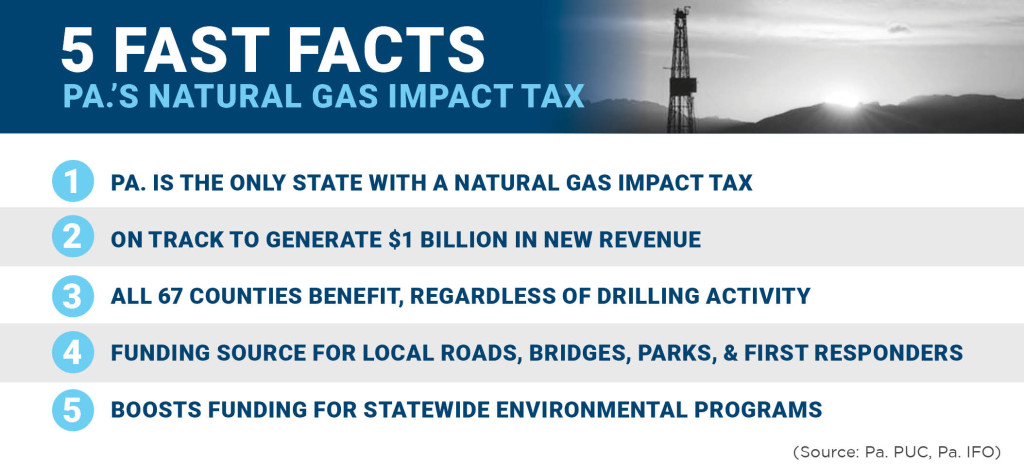

- “Little Sense for Policymakers” to Jam Through Job-Crushing Energy Tax Hike: Massive energy tax increases that some in Harrisburg are proposing will exacerbate the financial pressure facing Pa. natural gas industry, jeopardize the tens of thousands of good-paying Pa. jobs that it supports, and fail to raise significant, meaningful revenue. does tax natural gas – it’s called an impact fee. And we are the only state in the country to levy such a tax that will generate more than $1 billion for all 67 Pa. counties by April of this year. …. What’s more, other oil- and gas-producing states are proving the policy dangers of relying on severance tax revenues, as many face massive budget deficits and shortfalls. … It makes little sense for some Pa. policymakers to pursue the exact same policies that are harming other states. (York Daily Record letter, 2/18/16)

- “Couldn’t be a Worse Time for a Massive Energy Tax Increase”: By April of this year, Pa.’s impact fee will have generated more than $1 billion in new revenues. …However, other energy-producing states that rely on a severance tax are struggling with deep budget shortfalls as revenues spiral downward alongside commodity prices. New taxes and efforts to marginalize an important sector of our economy — as well as the thousands of men and women who work across it — will only exacerbate our difficult financial challenges during what a recent AlixPartners study termed “one of the severest downturns in 30 years.” It’s an unmistakable fact that every Pennsylvanian is realizing shale’s game-changing economic and environmental benefits. There couldn’t be a worse time for a massive energy tax increase. (Butler Eagle letter, 2/20/16)

Natural Gas Impact Tax Benefits Pa. Communities

- Impact Tax Revenues Improve Titusville Playground: In addition to Burgess Park receiving some fresh paving, the playground will receive a new bed of mulch, due to a grant written by City Finance Director Diana Durstine. … The Act 13 grant total is for $7,957, and will be used to purchase engineered wood fiber mulch. (Titusville Herald, 2/18/16)

- Rural Ambulance Services Receive Boost from Impact Tax: Municipalities are participating in the Cameron Co. Ambulance Service board following a funding pledge to ensure continued service to residents. Act 13 funds will provide much of the revenue. … Ambulance services across the state are struggling to provide services for residents, especially those in rural areas covering large territories and traveling significant distances to hospitals and medical facilities. (Bradford Era, 2/14/16)

- Natural Gas Impact Tax Funds Berks Co. Bridge Repair: Drivers who use Normal Avenue Bridge in Kutztown will have to take another route for several months as crews repair the 55-year-old span. … The 83-foot-long bridge, which crosses Sacony Creek near Kutztown Elementary School, is one of 59 bridges owned by the county. The nearly $1 million project is being funded with state community development aid and money Berks County receives from the Marcellus shale impact fee. The bridge will get a new deck, pavement, beams and sidewalks. (Reading Eagle, 2/23/16)

Become a United Shale Advocate today and join the thousands of Pennsylvanians telling Harrisburg policymakers to reject misguided, dangerous proposals for even higher energy taxes.