With Governor Wolf hosting a Facebook town hall today, the Marcellus Shale Coalition is posing five questions about the impact of job-crushing plans for higher energy taxes.

Here are the five – of many – questions. Be sure to check back after the Q&A to see if and how the Governor responds.

- Under current market conditions, Pennsylvania is already seeing a reduction in energy industry capital investment. Do you think this is the right time to increase Pennsylvania’s energy taxes, especially when such an increase will drive away more investment and threaten our economic growth?

- Multiple national and regional news outlets have reported higher energy taxes will slow industry growth and compromise Pennsylvania’s robust supply chain. How can you assure Pennsylvanians that your proposal for even higher energy taxes will not cost jobs?

- Pennsylvania’s shale revolution has unleashed billions of dollars in consumer savings – savings that greatly benefit the Commonwealth’s citizens. With higher energy taxes leading to increased utility costs, what does your plan mean for Pennsylvanians who have benefited from low-cost natural gas?

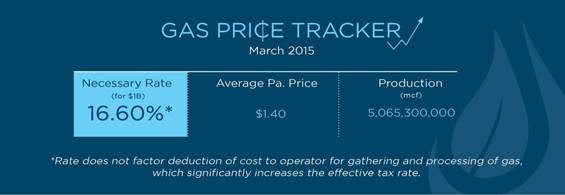

- The Associated Press recently reported that your proposal to increase Pennsylvania’s energy taxes would set a floor on the price at which the tax is calculated. Given current Pennsylvania market conditions, natural gas is not selling for anywhere close to the proposed minimum. This month, it was sold at an average of $1.40/tcf. At that price, the effective tax rate would have to be 16.6% in order to reach $1 billion. What effect do you anticipate this would have on the industry?

- The Commonwealth’s manufacturers are experiencing a rebirth thanks to shale’s low cost feedstock and utility savings. How will your plan for higher energy taxes – that will increase costs for American manufacturers – impact Pennsylvania’s manufacturing future?