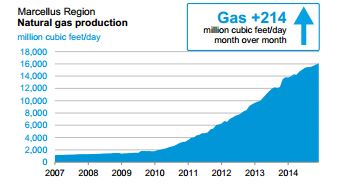

The responsible development of clean-burning natural gas from the Marcellus Shale continues to reach record levels, according to the U.S. Energy Information Administration’s (EIA) latest monthly drilling productivity report. At current production levels, the Marcellus Shale is on track to produce 25 percent of America’s natural gas demand in 2015. And to think that in 2008, Pennsylvania only produced 25 percent of the commonwealth’s natural gas needs, it’s truly a remarkable feat to witness just how prolific the Marcellus has been over a few short years.

The Pittsburgh Business Times reported under the headline, “Marcellus production to hit 16 billion cubic feet per day in December”:

Natural gas production from the Marcellus Shale region is continuing to flirt with the 16 billion cubic feet per day mark, according to U.S. Energy Information Administration estimates. According to the administration’s monthly drilling productivity report, November production will be about 15.9 billion cubic feet per day. The administration projects production will reach about 16.1 billion cubic feet in December.

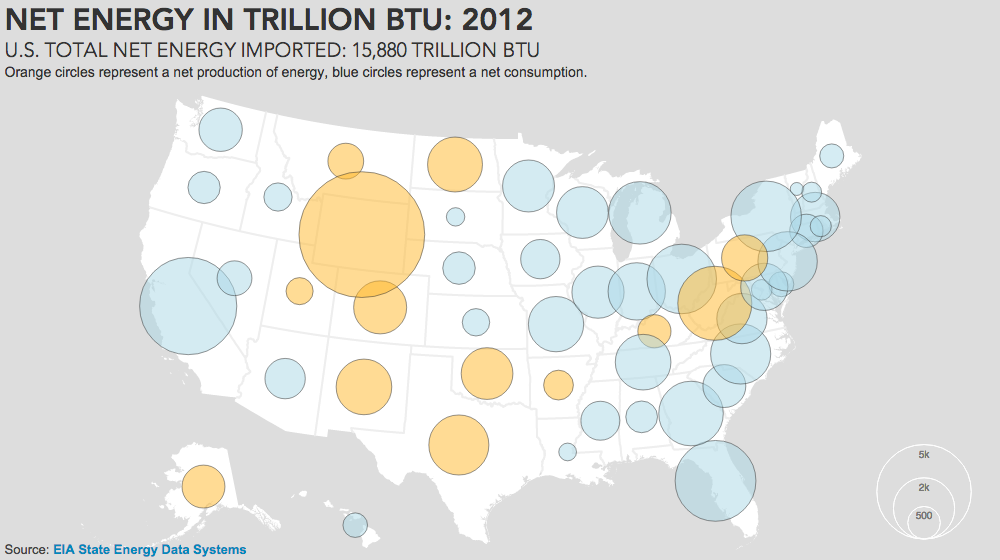

These previously unimaginable production levels are providing enormous benefits to consumers across our region and America. To be sure, the U.S. Department of Energy recently created maps that highlight how much energy each state produces and consumes. While natural gas makes up “the lion’s share of the energy that the U.S. produces,” it is even more notable that “energy giants” like Pennsylvania, West Virginia, Texas, Wyoming and Louisiana, “account for more than 42 percent of the total energy produced in the U.S. each year.”

And here is what they are saying about the benefits of locally produced natural gas:

- East Allegheny School Director: Shale Benefits “Long-Term”: The East Allegheny school board on Monday night voted unanimously to approve a lease agreement that will allow EQT Production Company to do Marcellus Shale drilling on district land. … The company will give an upfront payment of $3,500 per net acre to the district, or $596,000, the solicitor said. … Mr. Beisler said if the company starts drilling, the district will also receive 17 percent of the gross proceeds. School Director Frederick Miller said if EQT actually drills and finds gas, the royalty payments could be used to pay long-term expenses such as teachers’ salaries and pension costs. … The district is looking for ways to increase revenues and deal with a deficit that reached $1.158 million in 2013. “If it is advantageous to the district, it’s worth exploring,” school board President Gerri McCullough said. (Post-Gazette, 11/11/14)

- “Shale Gas in North America Has Become the Big Story”: Plastics manufacturers are counting on ethane processing plants tied to natural gas from the Marcellus, Utica and other shale regions in the United States to lift the industry out of its slow-growth pattern. … The low-cost ethane obtained from shale drilling could support scores of plants that make raw plastics, experts say. … “There is a reasonable likelihood that it would benefit us and larger plants in the region, presumably from downward pricing pressure,” said Chris O’Leary, who owns Kenson Plastics Inc. in Zelienople with his brother David. … Pennsylvania ranked sixth in the nation in plastics employment and with shipments of about $16.6 billion a year, according to the Society of the Plastics Industry Inc., a Washington–based trade association. … “Pittsburgh is the research and development center for Braskem in the United States, with a focus on polypropylene, our main business today,” Krishnaswamy said. “But in the future, it will include research on polyethylene derived from shale gas as well … shale gas in North America has become the big story. It is available in abundance and it is less expensive than the feedstock used today,” Krishnaswamy said. … “It’s not a wait-and-see game; it’s happening today,” Krishnaswamy said. “Shale gas is already having an effect.” (Tribune-Review, 11/8/14)

- Shale “Is a Long-Term” Opportunity: It’s why some of the most prolific producers in the Marcellus Shale are still spending more than they take in, nearly a decade into the shale game in Pennsylvania. “As we look at 2015 and we look at capital allocation … the most important thing to me is how do we create the greatest amount of value long-term,” Doug Lawler, CEO of Tulsa-based Chesapeake Energy Corp. told analysts last week. … Nick DeIuliis, CEO of Consol Energy Inc., put it, the Cecil-based energy company isn’t making decisions on today’s prices but on future trends. … Daniel Pratt, direct of energy company transaction research at IHS, wrote in a recent report that worldwide, exploration and production margins have tightened significantly while capital investment in 2013 totaled more than $720 billion, an 18 percent increase over the prior year. … “One thing that we’ve noticed in the market (is) that most of the people we’re speaking with have (a) much longer term horizon than the next six to 12 months,” said CEO Thomas Stabley. “So they understand the dynamics of what’s happening in Appalachian and see a better opportunity as we go forward.” (Post-Gazette, 11/11/14)

- Shell Buying Beaver Co. Land for Potential Ethane Cracker: Royal Dutch Shell agreed to buy the former Horsehead Holdings Corp. zinc smelter site in Beaver County as it continues to mull a decision on building a multibillion-dollar ethane cracker there. … It is awaiting environmental permits from the state and evaluating the economics of the plant, which would convert ethane from natural gas drilling into chemicals used to make plastic. … “The land purchase is a necessary step for Shell to advance the permitting process and allows us to proceed with some preliminary site development work.” (Tribune-Review, 11/7/14)

- Shell Completes Purchase of Pa. Site for Ethane Cracker: Shell Chemical has exercised its option to purchase the site of a former Horsehead zinc smelter in Beaver County, Pennsylvania, for a proposed ethane cracker, Horsehead said Friday. The proposed $4 billion ethane cracker would be the first of its kind in the US Northeast. … The option agreement to convert Horsehead’s 300-acre zinc smelter in Monaca, Pennsylvania, into an ethane cracker and petrochemical complex was initially signed in March 2012. “Shell can confirm the statement by Horsehead Corporation that we are exercising our land option to purchase Horsehead’s property in Beaver County, PA, having determined that the site is suitable for the potential development of our proposed facility,” spokeswoman Kimberly Windon said in an email Friday. … Shell’s ethane cracker, expected to be completed in 2019, would feed production of 1.5 million mt/year of ethylene, 500,000 mt/year of gas-phased high density polyethylene, 500,000 mt/year of slurry HDPE, and 500,000 mt/year of linear low density polyethylene, the report said. (Platts, 11/7/14)

Read the fall edition of Marcellus Quarterly Magazine HERE for more shale-related news; and be sure to follow us onTwitter and like us on Facebook for the latest information on safe, job-creating shale development.