Pennsylvania’s economy – thanks in large part to job-creating shale development – is on a path toward recovery, with more private sector jobs being created each day:

- “Pa. unemployment rate drops to lowest point since September 2008” (Associated Press, 6/20/14)

- “Pa. unemployment dips to lowest level since September 2008” (Pittsburgh Post-Gazette, 6/20/14)

- “Pa. May unemployment rate at lowest level since recession began” (Pittsburgh Business Times, 6/20/14)

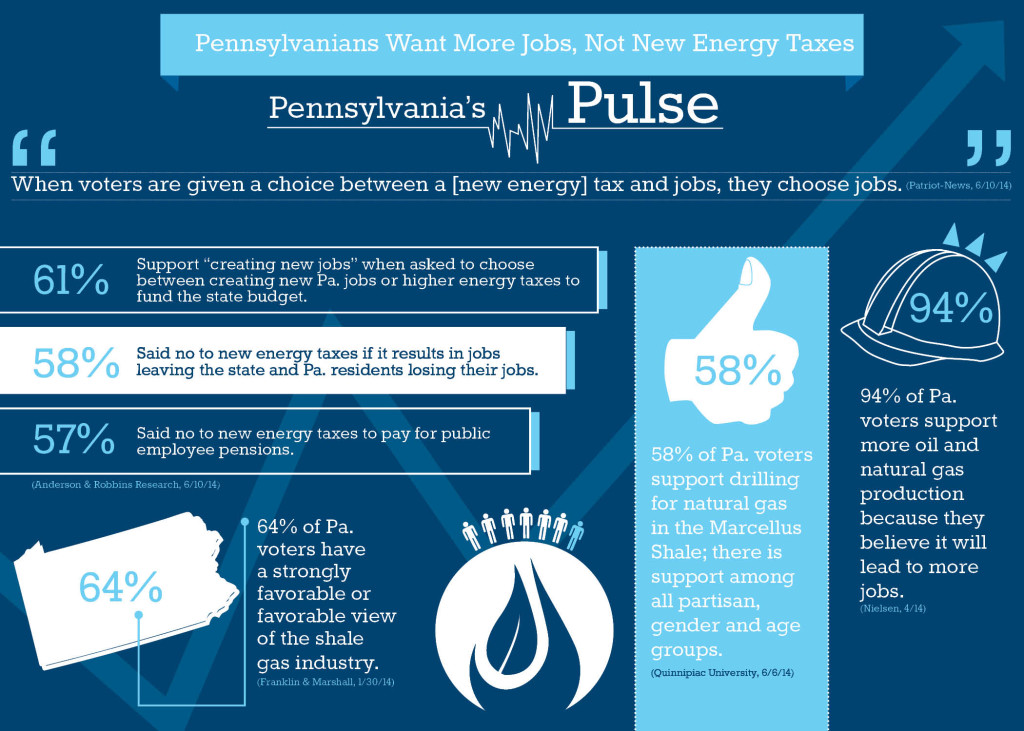

That’s the good news. Unfortunately – while Pennsylvania voters across the political spectrum reject new energy taxes in favor of jobs and the economic growth tied to natural gas – some policy makers and office seekers are promoting misguided and short-sighted taxes that could undercut this positive progress.

The Associated Press reports on the potentially harmful economic consequences of a new job-killing energy tax [full letter here]:

Pennsylvania’s three biggest oil and gas associations, which represent multinational giants, are warning state lawmakers in a letter that raising taxes on the booming Marcellus shale natural gas industry could have economic repercussions.

The letter, obtained Friday by The Associated Press, was signed by the heads of the Associated Petroleum Industries of Pennsylvania, Marcellus Shale Coalition and Pennsylvania Independent Oil & Gas Association.

The trio said the enactment of a severance tax, like other major gas-producing states impose, could make Pennsylvania less competitive and drive the companies to shift crews and rigs to other states.

“The development of the industry is still far from complete,” the letter said. “Further expansive capital investment is needed and a severance tax could stunt the growth of this very promising industry.”

It said, for example, that the natural gas being found in Ohio and West Virginia is rich in liquids that can be processed into other fuels, making it more valuable than the “dry gas” found in much of Pennsylvania.

Here’s what else they’re saying about new job-crushing energy taxes:

- New Energy Taxes “Would Hurt Farmers”: Natural gas companies already pay the second-highest corporate tax rate in the world, along with impact fees that pay for bridge and road repairs as well as royalties to land owners. Singling out the industry to pay another tax is not only unfair but also would hurt farmers, such as Shawn Georgetti from Washington County, and others who rely on the industry for jobs. He was living paycheck to paycheck, but thanks to the Marcellus Shale boom, he received a natural gas lease, allowing him to improve his farming equipment and his standard of living. If businesses, like drilling companies, are devoting more money to paying taxes, then they’ll have less available to increase wages, hire new workers, or give people like Shawn Georgetti a chance at a better life. With government spending at an all-time high, the commonwealth should be focused on addressing its long-term fiscal woes, not burdening Pennsylvanians with even higher taxes. The opportunity to restore fiscal responsibility is now, before the hole gets deeper and the solution more painful. (Morning Call op-ed, 6/20/14)

- New Energy Taxes Will “Hamper Economic Growth”: The Marcellus Shale Coalition industry group says that raising taxes on drilling would suppress drilling activity and lead to fewer direct and industry-supported jobs in Pennsylvania. “New energy taxes to fill a budget gap is short-sighted, will put Pennsylvania at a disadvantage when competing for capital investment and hamper economic growth at a time our state needs jobs most,” Dave Spigelmyer, the group’s president, said. (Post-Gazette, 6/21/14)

- “New Shale Tax Would Sting” Pa. Communities: A proposal by the Pennsylvania legislators to enact a new tax on shale drilling could hurt local governments and the state’s economy. Concerned citizens should contact legislators to derail this misguided tax. Act 13, the 2012 law that established the per-well fee paid by energy companies, has pumped millions of dollars into the tri-county area. … Washington County Commissioner Larry Maggi said, “They see a golden goose and want to strangle it.” Local officials are especially worried about this tax plan. … Butler County Commissioner William McCarrier shares this concern: “I don’t want to tax something to the point that we drive it out.” As McCarrier notes, not only could this tax reduce the amount of revenue going to local governments, it could kill jobs. These short-sighted tax schemes are based on politics, not economics. … This tax plan is a threat to shale gas production. That’s something that should concern everyone in Clearfield and Centre counties. (Centre Daily Times letter, 6/17/14)

- “Energy Tax The Wrong Answer”: Shale development is breathing new economic life into our region while protecting and enhancing our environment through lower-cost, clean-burning natural gas. We’re creating more jobs and providing the energy we need to keep our economy strong. And a new poll shows that Pennsylvanians overwhelmingly support more jobs over new energy taxes. Unfortunately, some elected officials and those seeking office want to pass new energy taxes that could hurt job creation, stifle manufacturing and increase energy costs. Let’s continue to see through election-year politics and work together to get this generational opportunity right — now and for years to come. (Tribune-Review letter, 6/18/14)